Even the banking industry is taking advantage of technology these days. Now, people can open a bank account online, and they don’t have to be concerned that their accounts will not be secure. This is giving everyone the chance to attend to their banking needs in the manner in which they see fit. Learn the following four things that you must remember before you open a bank account online:

Table of Contents

1. Is the Online Bank Insured by the FDIC?

The Federal Deposit Insurance Corporation or FDIC is the institution that insures all deposits in checking, type of savings account, certificates of deposit and money market accounts. Each account is insured for deposits of up to $250,000 against the failure of the bank. In most instances, online banks are insured by the FDIC, but this is something that customers must determine before they open a bank account online.

Each financial institution has a “BankFind” tool that customers can use to learn if the bank is insured by the FDIC. This is each person’s responsibility, so everyone must take this step.

2. Can Customers Pay Their Bills Online?

Online banks make it easy for customers to pay their bills online. This option eliminates the unnecessary waste of paper, and it makes it easier to manage the payment of bills. Online banking makes it possible to organize one’s finances better, and this has resulted in reducing the amount of stress people are under. To find out exactly what an online bank offers in payment options, people must make sure that they ask the question directly before opening an account.

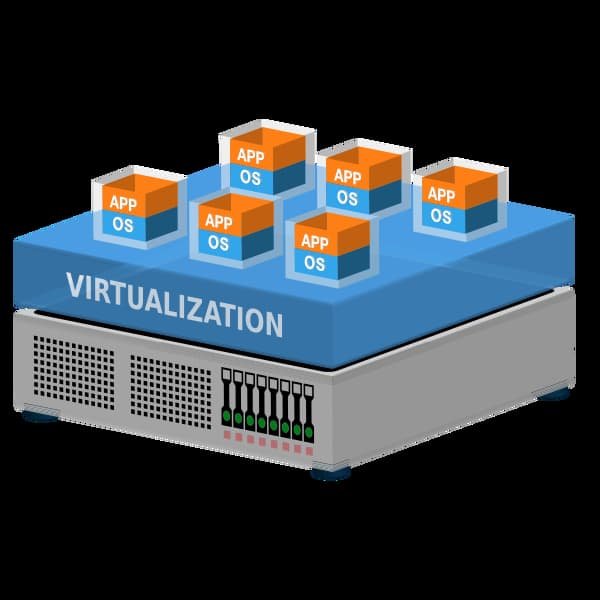

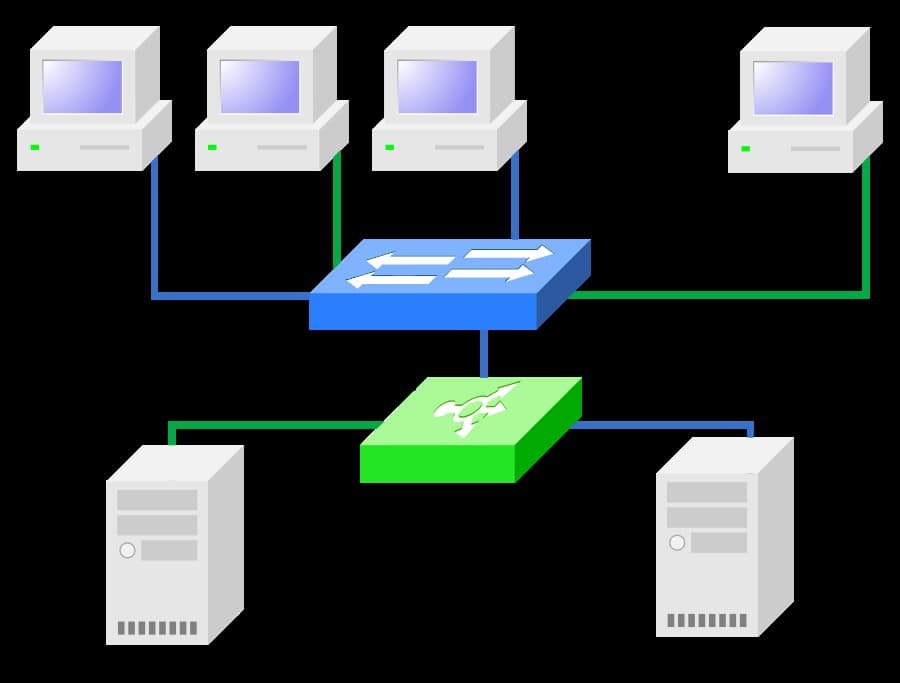

3. Does the Financial Institution Have a Mobile App?

Mobile apps are highly convenient, and most banks offer them to customers. Mobile apps make it possible for customers to perform banking transactions at any time of the day. Mobile apps are the reason that most customers can remain up to date on what is going on in their bank accounts.

4. Are There a Variety of Financial Products?

Some people open a bank account online because they want to focus on a specific goal, but online banks are now places where people can obtain a wide variety of financial products and services. The only product that people could open at an online bank used to be a savings account, but that is not the case today. Online banks now offer savings accounts, loans, currency transactions, credit cards, money market accounts, certificates of deposit, debit cards, and even international money transfers.

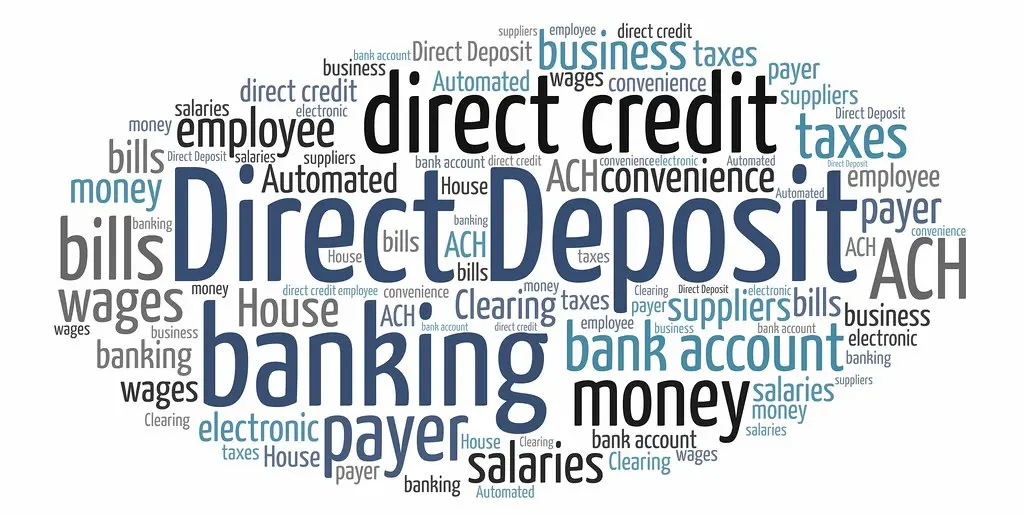

According to the experts at SoFi, “Customers will earn a 1.00% APY interest rate on their checking and savings accounts if they sign up for a direct deposit”. This interest rate is 33 times the average interest rate. If a customer doesn’t wish to have a direct deposit, he or she will have a 0.25% APY, and this is eight times the national interest rate of other banks. SoFi can offer interest rates as high as these because it is an online bank and doesn’t have the expenses of a traditional bank. Also, new customers will not be charged fees for their accounts.

Read also: What Are The Advantages Of A Bank Savings Account Quizlet

0