Key Takeaways:

- Understand the role of real estate investment firms in achieving financial freedom.

- Learn the benefits of investing in real estate through professional firms.

- Discover how to select a reliable real estate investment firm.

- Gain insights into managing and optimizing your property investments.

Table of Contents

Why Real Estate Investment is a Path to Financial Freedom

Real estate has long been considered a stable and profitable investment vehicle. It offers the potential for significant returns through rental income, property appreciation, and tax benefits. Collaborating with a real estate investment firm can streamline this process, providing expert guidance and access to lucrative opportunities. These firms help investors navigate complex market dynamics and make informed decisions.

Moreover, real estate investments act as a hedge against inflation. When inflation rises, so do property values and rental incomes, protecting your investment from losing value. With the right firm, you can scale your investments efficiently, capitalizing on market trends and opportunities.

Benefits of Partnering with a Real Estate Investment Firm

Real estate investment firms offer several advantages, including professional property management, access to exclusive deals, and comprehensive market analysis. They mitigate risks by performing thorough due diligence and leveraging their expertise in property management and investment strategies.

Partnering with such firms provides a more hands-off investment experience. Investors benefit from rental income and property appreciation without dealing with the day-to-day management tasks. Firms handle everything from tenant screening and property maintenance to legal compliance, ensuring your investments are well-managed and profitable.

Professional Management and Expertise

Professional management ensures that your properties are maintained, tenants are satisfied, and rental incomes are collected on time. Firms employ experienced property managers who handle all aspects of property care, allowing you to focus on growing your portfolio.

Real estate investment firms also utilize sophisticated analytical tools to monitor market trends and furnish actionable insights. This data-driven approach enhances decision-making and optimizes investment strategies, ensuring maximum returns.

Access to Exclusive Deals and Opportunities

Real estate investment companies frequently have access to off-market transactions and prospects for bulk purchases, giving investors distinctive and lucrative investing choices. These exclusive deals can yield higher returns compared to traditional market listings. By leveraging their extensive network, firms can identify and acquire high-value properties before they hit the open market.

Furthermore, firms can negotiate better terms and prices due to their purchasing power and market knowledge. This advantage is particularly beneficial in competitive markets with scarce opportunities and prices.

How to Choose a Reliable Real Estate Investment Firm

Selecting the right firm is crucial for your investment success. Look for firms with a strong track record, transparent fees, and positive client testimonials. Assessing their market expertise, property management capabilities, and investment strategies is also essential.

Investigate companies online and read reviews on Trustpilot and the Better Business Bureau. It also guarantees that the firm’s charge structure is straightforward, unambiguous, and free of additional expenses.

Evaluating Market Expertise and Track Record

Key factors in determining a company’s success are its capacity to recognize successful investment possibilities and comprehend the real estate industry. Seek out companies with a track record of profitable investments and steady expansion.

Moreover, consider their expertise in specific markets or property types. A firm specializing in commercial properties may differ significantly from one focusing on residential investments. Choose a firm aligning with your investment goals and preferences.

Transparency and Communication

Transparency is vital when dealing with any financial institution. Ensure the firm communicates its strategies, fees, and potential risks. Regular updates and open communication build trust and inform you about your investments’ performance.

Clear communication regarding potential risks and market conditions helps investors make well-informed decisions. A reputable firm will avoid discussing challenges and provide comprehensive risk mitigation plans.

Managing and Optimizing Property Investments

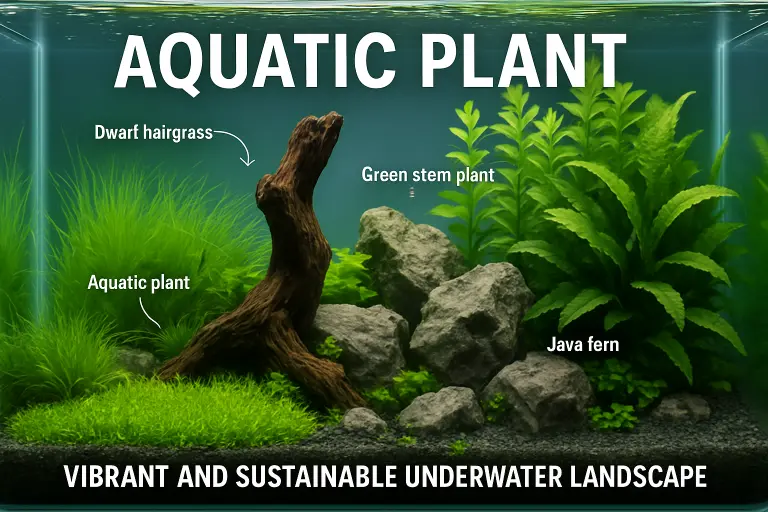

Sufficient property administration is essential for optimizing profits and reducing empty spaces. Real estate investment companies cover everything from property upkeep and regulatory compliance to tenant relations and rent collection. Thanks to this thorough management, your investment will continue to be hassle-free and rewarding.

Regular property inspections, timely maintenance, and prompt responses to tenant issues enhance tenant satisfaction and retention. Firms also implement rental pricing strategies based on market trends, ensuring competitive rental rates.

Latest Trends and Technologies in Real Estate Investment

Technology has significantly transformed the real estate investment landscape. Property management software, virtual tours, and blockchain technology streamline operations and enhance transparency. Keeping abreast of these trends can provide a competitive edge.

For example, property management software automates many routine tasks, allowing property managers to focus on strategic activities. Virtual tours enable remote property viewing, attracting potential tenants from wider geographic locations.

Additionally, IoT devices monitor property conditions in real-time, enabling predictive maintenance and reducing costly repairs. Blockchain technology ensures transaction transparency and security, fostering trust between investors and managers.

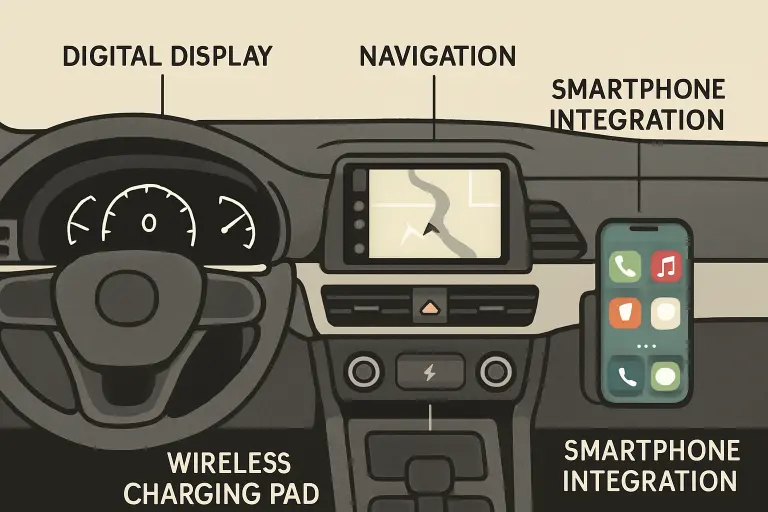

Adoption of Smart Technologies

Smart home devices, energy-efficient installations, and advanced security systems enhance property value and attract tech-savvy tenants. These technologies provide added convenience and lower utility costs, making properties more appealing.

Furthermore, intelligent data analytics helps in predictive maintenance and optimizing property performance. Property managers can identify potential issues early and address them by analyzing data from IoT devices and other sources before they escalate.

0