Before you pick out your dream vehicle, it’s essential to take strategic steps that safeguard your wallet from unnecessary strain, leaving you confident both on the road and in your budget.

Purchasing a new car is a thrilling milestone, but ensuring it aligns with your financial goals takes careful planning. The journey from assessing your budget to sealing the deal at one of the dealerships in Tampa is more than just comparing car models—it’s about preparing your finances. Hence, your new ride enhances, not hampers, your lifestyle.

Table of Contents

Assess Your Financial Situation

The first step to smart car buying is understanding your current financial position. Calculate your monthly net income and subtract essentials like rent, utilities, groceries, and debt payments. This will reveal your available funds for a car payment. Creating a detailed monthly budget helps clarify what you can comfortably commit to transportation expenses without dipping into savings needed for emergencies or other goals. Many experts recommend using trusted budgeting apps or tools for this evaluation.

Set a Realistic Budget

Financial planners urge that your total car cost—including the loan payment, insurance, maintenance, and fuel—should not exceed 15-20% of your monthly take-home pay. If your income is $4,000 per month, aim to keep all car expenses below $800. This safeguard prevents financial overextension and leaves room for unexpected costs or savings opportunities.

Save for a Down Payment

A substantial down payment not only lowers your monthly payments but also reduces total interest paid over the life of the loan. Aiming for 20% of the car’s purchase price is wise—on a $30,000 car, that means saving around $6,000. Bigger down payments may qualify you for better interest rates and show lenders you’re a responsible borrower. Whether you’re planning to buy from a private seller or exploring auto dealers in Tampa FL, a solid financial strategy gives you more leverage. Consider creating a high-yield savings account dedicated solely to this goal to help your funds grow while you save.

Explore Financing Options

If you aren’t paying cash, shop for the best financing terms. Compare offers from banks, credit unions, and dealerships. A shorter loan term often means higher monthly payments but saves substantially on interest, while longer terms increase total interest paid. Securing pre-approval before you visit the dealership can give you a stronger bargaining position and solidify your budget ceiling.

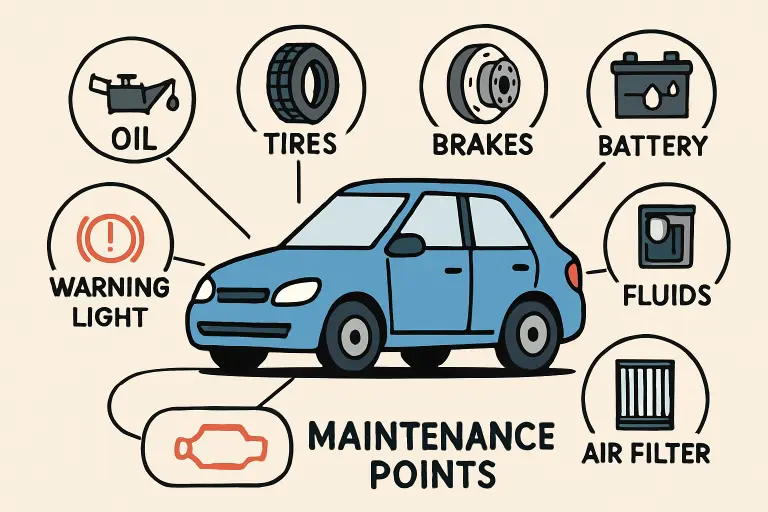

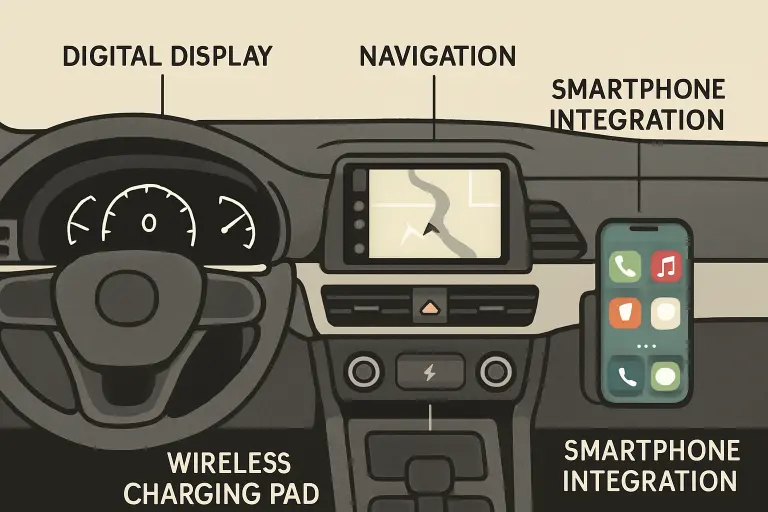

Consider Total Ownership Costs

The cost of car ownership extends beyond the purchase price. Factor in insurance—which varies based on factors like your location, driving history, and chosen model—alongside variable fuel costs, regular maintenance, and registration fees. Maintenance expenses are manageable with regular service, but unexpected repairs can still crop up, so setting aside a small buffer in your monthly budget is wise.

Time Your Purchase Strategically

When you buy, it can be almost as important as what you buy. Dealers often roll out lucrative promotions at the end of the month, during holiday sales events, or at the end of the model year to move inventory. Take advantage of these timings to secure the best price and possible incentives like cash-back offers or reduced financing rates. Signing during a special event can mean saving thousands on the sticker price or qualifying for attractive add-ons at no extra cost.

Negotiate the Best Deal

Once you’ve chosen your car and secured financing, don’t hesitate to negotiate. Research the fair market value beforehand and have a maximum price in mind to prevent overspending. Ask about bundled extras, such as free routine maintenance, all-weather floor mats, or extended warranties, which add value to your deal. If negotiations stall, remember you have the power to walk away—dealers often come back with an improved offer to earn your business.

Approaching your new car purchase with careful financial preparation guarantees that your investment enhances your lifestyle without overburdening your wallet.

0