In the quickly developing sphere of financial technology, widely famous as fintech, user experience design performs an essential role in crafting understandable and catching digital platforms. As financial services keep on crossing over from traditional institutions to online platforms, the significance of ensuring unhindered and convenient experiences for individuals should not be underestimated. Let’s have a closer look at the latest fintech UX design tendencies and how they form the industry and revolutionize the way individuals interplay with financial technology.

Table of Contents

Facilitation and Convenience

One of the brightest tendencies in UX fintech design is minimalism. The conception of “less means more” is adapted to interface design, highlighting lucidity and plainness. By eliminating needless mess and visual noise, fintech platforms may grant clean and optimized experiences to individuals. Minimalist design can not just raise the visual attractiveness of the interface but likewise enhance the general convenience of use and availability, simplifying navigation and performance of financial assignments to individuals.

Individualization and Personalization

As fintech platforms collect more user information, they may utilize this data to grant personalized experiences. Customization lets individuals adapt the platform to their concrete necessities and preferences. By proposing personalized pieces of advice, relevant content, and notices, fintech platforms may craft a feeling of individualized attention that increases user involvement and satisfaction.

Dialogue Interfaces

Dialogue interfaces, in particular, chatbots and voice helpers, have obtained considerable popularity in fintech UX design. These interfaces utilize the processing of natural language and AI to relieve human communication with users. Chatbots may ensure immediate client support, respond to requests, and guide users through challenging financial processes. Voice helpers that are integrated with virtual banking services let individuals make financial transactions employing voice commands. Dialogue interfaces raise user involvement and make troublesome financial interactions easier, making fintech platforms more available to a broader audience.

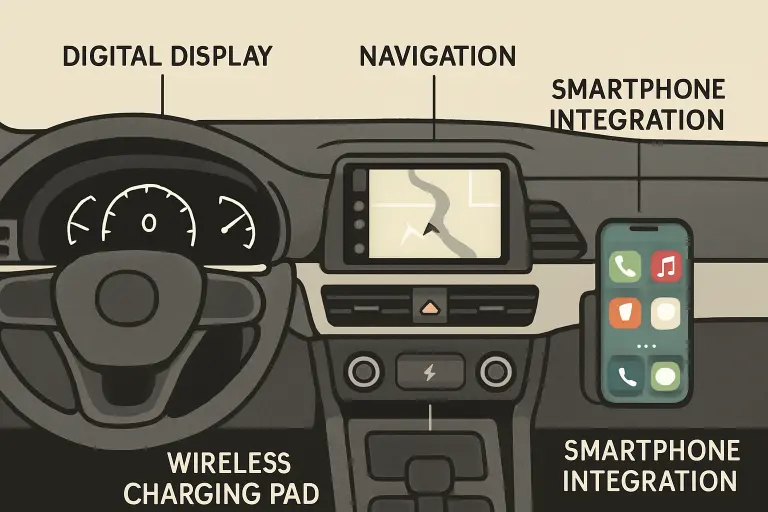

Mobile Approach

With the broad spread of various smartphones, mobile appliances are now the major means to get access to financial services. Fintech organizations apply a mobile approach to UX design more often, guaranteeing that their platforms are streamlined for mobile appliances. The mobile design gives priority to adaptive layouts, sensory interplay, and simplified navigation, letting individuals interact with fintech apps without let or hindrance on their smartphones. This tendency is conditioned by the convenience and ubiquitous distribution of mobile appliances, oriented on the mobile lifestyle of contemporary clients.

Biometric Identification

Safety is of utmost importance in the fintech sphere. That’s why biometric identification/authentication is becoming a leading tendency in user experience design. Biometric authentication techniques, in particular, fingerprint scanning, voice identification, and facial recognition propose increased convenience and safety. These techniques remove the necessity to apply traditional passwords, decreasing the risk of unauthorized access and data breaches. Complete integration of biometric identification into the UX design improves the user experience by making the login process easier and granting a higher level of safety.

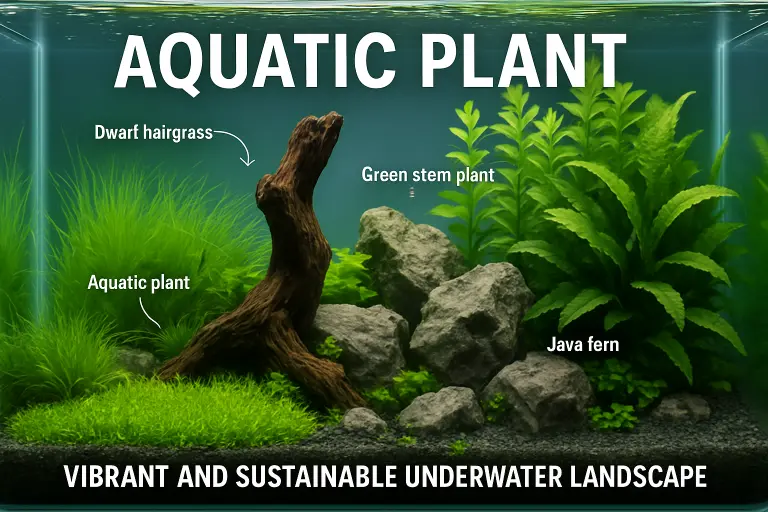

Visualization of Data

Since fintech platforms gather huge amounts of user information, presenting this data in a visually attractive format is of high importance. Methods of data visualization, for instance, charts and graphs may assist individuals in comprehending challenging financial information at first sight. Fintech platforms may utilize data analytics to grant personalized information, budgeting pieces of advice, and spending models, enabling individuals to make justified financial decisions. Data visualization and analysis let individuals keep track of their financial progress and drive their finances effectively.

Gamification Components

To make managing finance more fascinating and pleasant, fintech platforms begin to include gamification components in their UX design. Gamification technology, particularly, progress indicators, accomplishments, rewards, and tasks, turn routine financial assignments into interactive and useful experiences. By addressing the natural inclination of individuals to competition and accomplishments, gamification induces users to interact with financial platforms actively, contributing to the long-term loyalty of users and promoting positive financial habits.

How UX Design Trends Impact the Best Fintech Design?

Fintech UX design trends possess a considerable influence on forming the best fintech design practices. These tendencies impact the approach of designers to user experience and assist them in crafting intuitive, catching, and convenient fintech platforms.

Request Aid from Fintech Design Agency

If you don’t have time to follow the latest Fintech UX design trends, there is no necessity to be concerned. The team of the Arounda agency is familiar with the current tendencies. Thus, if you require aid with your Fintech digital products, you can surely count on the support of the Arounda experts. Leaning upon this fintech design agency may bring a lot of pros for your fintech business. Let’s consider a few weighty reasons to think about cooperation with the Arounda fintech design agency.

Experience Guaranteeing Amazing Fintech App Design

Arounda specializes in elaborating user experiences for financial technology platforms. Its team possesses a deep comprehension of the unique issues, requirements, and top methods typical for the fintech sphere. Experience of Arounda lets it bring its knowledge to your project, guaranteeing that your fintech platform will be elaborated in accordance with the highest standards.

Knowledge of Trends in Fintech Design

The Arounda agency is always aware of the latest tendencies, technologies, and regulatory alterations within the fintech sphere. It has valuable information about user expectations, new design methods, and market dynamics.

Money-Saving

Although cooperation with a fintech design agency needs investment, it may turn out to be economic in the long run. Operation with Arounda lets you obtain access to the command of on-demand specialists, paying for their services on the basis of project requirements. This may be budget-friendly and cost-effective.

Conclusion

To sum up, fintech UX design is constantly developing to correspond to the continuously-altering necessities and expectations of users in the digital era. By paying attention to definite tendencies, in particular, simplicity, personalization, design that is oriented on mobile devices, dialogue interfaces, data visualization, biometric identification, and gamification components, fintech platforms will possess the possibility to craft breathtaking and convenient experiences for individuals. Since the fintech sphere keeps on expanding and introducing innovations, giving priority to UX design will be of decisive importance for stimulating user adoption, involvement, and general success in the competitive environment of financial technology.

0