We’ve all been there—facing a financial dilemma or struggling with money management—and suddenly, a well-meaning friend or family member swoops in with their unsolicited advice. While they may have the best intentions at heart, it’s important to remember that not all financial advice is created equal. In fact, some commonly repeated money tips could end up doing more harm than good. So, when it comes to navigating the world of personal finance, it’s always best to do your own research and take advice with a grain of salt. Here are five common pieces of personal finance advice that you should ignore to keep your finances and credit in good shape.

Table of Contents

1. “Getting Out of Debt is a Piece of Cake!”

While it’s true that getting out of debt is a worthwhile goal, it’s far from a piece of cake. In fact, it often requires a lot of hard work, discipline, and patience. Beware of anyone who tells you that eliminating debt is a quick and effortless process. It usually involves making tough choices, creating a realistic budget, and sticking to a debt repayment plan.

Remember, if it sounds too good to be true, it probably is. Avoid falling for the promises of debt consolidation schemes or “magic” solutions that claim to wipe out your debt overnight. Instead, focus on developing good financial habits, such as reducing unnecessary expenses, increasing your income, and consistently paying down your debts. Slow and steady wins the race when it comes to getting out of debt.

2. “Credit Cards Are Evil—Cut Them Up!”

It’s a common misconception that credit cards are inherently evil and should be avoided at all costs. While it’s true that misusing credit cards can lead to financial trouble, they can also be powerful tools when used responsibly. Credit cards offer convenience, consumer protection, and the opportunity to build a positive credit history.

Rather than cutting up all your credit cards, focus on using them wisely. Pay your bills on time, keep your credit utilization low, and take advantage of the rewards and benefits offered by your cards. Remember, it’s not the credit cards themselves that are evil—it’s the lack of financial discipline and responsible usage that can lead to trouble.

3. “Always Pay Off Your Mortgage Early”

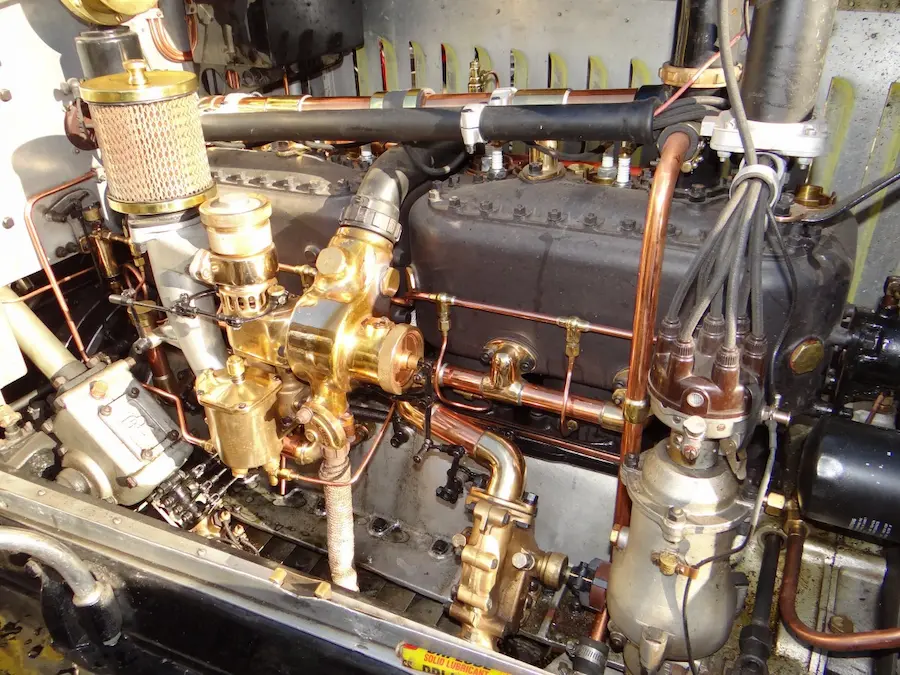

Paying off your mortgage early may seem like a noble goal, but it’s not necessarily the best financial decision for everyone. Before you rush to make extra payments or refinance your mortgage to shorten the term, consider the bigger picture. Mortgage interest rates are often relatively low, and you may be better off investing your money elsewhere, such as in a retirement account or a diversified portfolio.

Additionally, paying off your mortgage early can tie up a significant portion of your liquidity, which may leave you cash-strapped in case of emergencies. Instead, focus on striking a balance between saving for the future, investing wisely, and comfortably managing your mortgage payments.

4. “Always Buy a House—It’s a Great Investment!”

Owning a home can be a fulfilling experience, but it’s not always the best investment for everyone. The notion that buying a house is the ultimate financial goal is outdated and oversimplified. The real estate market can be unpredictable, and the costs associated with homeownership extend beyond the monthly mortgage payment.

Consider factors such as location, market conditions, maintenance costs, and your long-term plans before making the decision to buy a house. Renting can offer flexibility, and investing in other assets, such as stocks or real estate investment trusts (REITs), may provide better returns in certain situations. Remember, buying a home is a personal choice that should align with your financial goals and circumstances.

0