Buying a car is an exciting milestone. However, the financing process can seem daunting. This comprehensive guide on car financing covers loans, leasing, procedures, and tips – equipping you with everything you need to know to get the keys to your dream car.

Table of Contents

Key Takeaways:

- Spread costs over months/years via financing to ease budget strain.

- Weigh the pros and cons of traditional loans vs leasing as key options.

- Use online tools to calculate total affordability before setting monthly payment goals.

- Get pre-approved financing to enable better negotiations and constrain purchases to budget.

- For used cars, favor certified pre-owned with warranties and consider the annual percentage rate (APR).

Why Financing Beats Buying a Car Outright

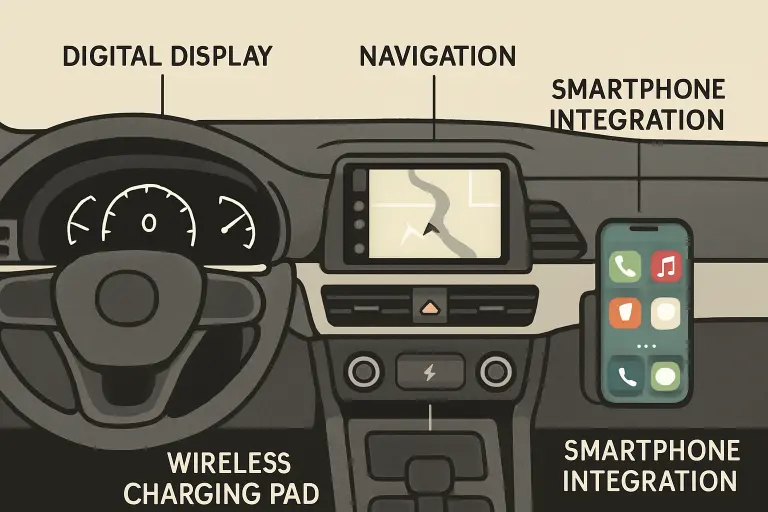

Financing spreads payments over months or years, easing budget strain. Even those with adequate savings may wish to invest lump sums rather than sink funds into depreciating assets like cars. Whether borrowing money or not, financing allows you to drive newer cars with advanced features.

Car Loans: Pros, Cons, and Process

Taking out a car loan lets you buy and then gradually repay. However, you must pay financing costs like interest.

What Factors Impact Your Loan and Interest Rate?

Lenders examine your credit score, rating, income, existing debts, and down payment amount. Those with higher credit scores get lower interest rates. Provide a larger down payment to reduce financing costs.

How Do You Apply and What’s the Process?

Many apply easily online. You’ll need personal details, employment info, and documents like recent pay stubs to apply for a loan. If pre-approved, you can negotiate at dealerships or with private sellers and then complete financing terms later.

Should I Use Bank Financing or Dealer Financing?

Banks often offer lower interest rates. However, dealers incentivize financing through them via car price discounts. Shop around for the best auto loan rates and terms.

Leasing: An Alternative Financing Option

Leasing has unique pros and cons compared to traditional loans.

How Does Leasing Differ from Financing?

With leasing, you only pay for the vehicle’s depreciation – the difference between MSRP and projected residual value when the lease ends. This leads to lower monthly payments. However, lessees must return or buy vehicles outright to keep them long-term.

What are Key Considerations Around Leases?

Leases limit annual mileage, typically to 12,000 or 15,000 miles. Going over incurs fees. Leases also require maintenance adherence, and you must return vehicles in good condition or pay additional charges. Factor such costs before leasing.

Calculators and Tools to Determine Affordability

To calculate affordability, lenders total monthly payments, insurance, gas, maintenance, and repairs. Online car loan and lease calculators let you input figures like vehicle price, down payment, trade-in value, loan amount, interest rate, and term length to determine budget viability better.

How Much Should I Borrow? Can I Get Pre-Approved?

Focus first on total affordability, not desired monthly payments. With lending pre-approval, you can define affordable payments over terms like 60 or 72 months, determining your maximum borrowing amount. Pre-approval also makes negotiating easier by demonstrating financing ability.

Further Tips: From Shopping to Securing Financing

Test driving models offer little indication of long-term budget fitness. Here are tips to match purchases to financing realities:

- Get pre-approved financing before visiting dealers, even if you are still narrowing choices.

- Treat the approved financing amount as your maximum budget, not the monthly payment amount.

- Prioritize reliability and fuel efficiency over prestige or performance.

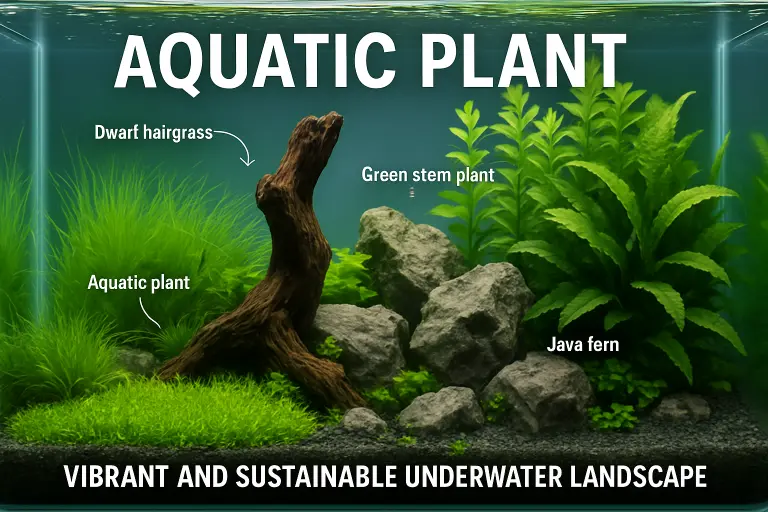

- For used vehicles, purchase certified pre-owned with extended warranties using loans or leases designed for such cars.

By better understanding loans, leasing, budget calculations, and intelligent negotiation strategies, you can turn exciting car dreams into lasting, accessible reality. Use this guide as your roadmap to navigate the financing process of applying for a loan from start to finish. Soon, you’ll have the keys right where they belong – in your hands.

Frequently Asked Questions (FAQs)

1. What are the different options for car financing?

When financing a car, you have various options, such as a traditional car loan, lease, or even auto financing. With a conventional car loan, you borrow money to buy the car and repay the loan with interest over some time. On the other hand, with a lease, you rent the car with fixed monthly payments and can either return the car or buy it at the end. Auto financing includes options to buy a car, lease a car, or even return the car at the end of the financing term.

2. How can I improve my chances of getting approved for car financing?

To increase your chances of getting approved for car financing, it’s essential to have a good credit score. Lenders use your credit rating to assess your creditworthiness and the interest rate they offer you. A steady income and a low debt-to-income ratio can also improve your chances of getting approved for a car loan or lease.

0