In life, unexpected expenses can sneak up on you when you least expect them. Whether it’s a medical emergency, a car repair, or a sudden home repair, these unexpected bills can leave you feeling financially stranded. During such times, a payday loan fast approval can be a lifesaver, providing a convenient and swift solution to tide over temporary financial hurdles.

Table of Contents

Understanding Payday Loans

So, what exactly are payday loans? Payday loans, also known as cash advance loans, are short-term, small-dollar loans designed to help individuals bridge the gap between paychecks when they face unexpected expenses. They are a convenient option for those who need quick access to funds and cannot wait for their next paycheck.

The Speedy Solution

One of the most significant advantages of payday loans is their speed. Traditional bank loans often involve a lengthy application process and may take days or even weeks to get approved. In contrast, payday loans offer a much faster solution. Most payday lenders can provide you with the funds you need on the same day or within 24 hours of your application being approved.

No Credit Check Required

Another appealing aspect of payday loans is that they typically do not require a credit check. This means that you can still qualify for a payday loan even if you have a less-than-perfect credit score. Traditional lenders often scrutinize credit history, making it challenging to secure a loan for individuals with poor credit. On the other hand, payday loans focus more on your ability to repay the loan based on your current income.

Convenience at Your Fingertips

Payday loans are incredibly convenient. Most lenders have online platforms that allow you to apply for a loan from the comfort of your home or office. You can fill out the application, submit the necessary documents, and receive approval without the need for in-person meetings or extensive paperwork.

Flexible Repayment Options

Payday loans are designed to be repaid quickly, usually on your next payday. This short-term nature means you won’t be carrying the burden of debt for an extended period. Moreover, some lenders offer flexible repayment options, allowing you to tailor the loan to your specific needs.

Transparency is Key

Responsible payday lenders are committed to transparency. They provide you with all the necessary information about the loan terms, including the interest rate and fees, upfront. This transparency helps borrowers understand the total cost of the loan, making it easier to plan for repayment.

Who Benefits from Payday Loans?

Payday loans can be a valuable financial tool for various individuals and situations. Here are some scenarios where a payday loan with fast approval can save the day:

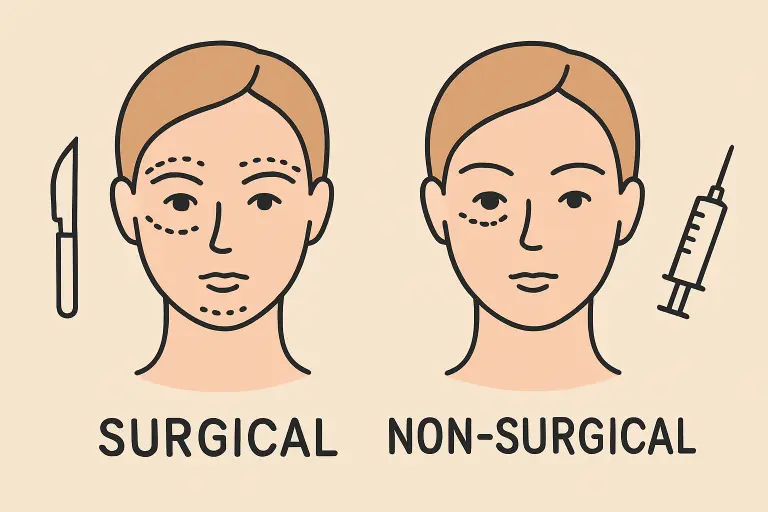

Emergency Medical Expenses: Health emergencies can be both physically and financially draining. Payday loans can help cover medical bills when insurance falls short.

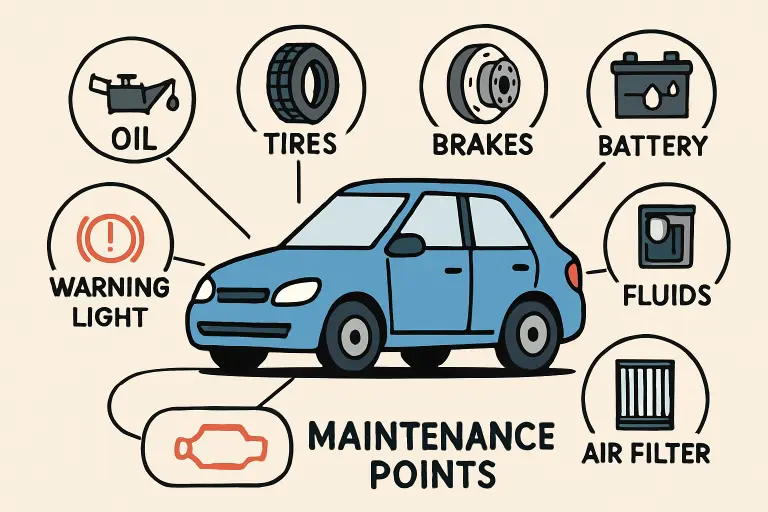

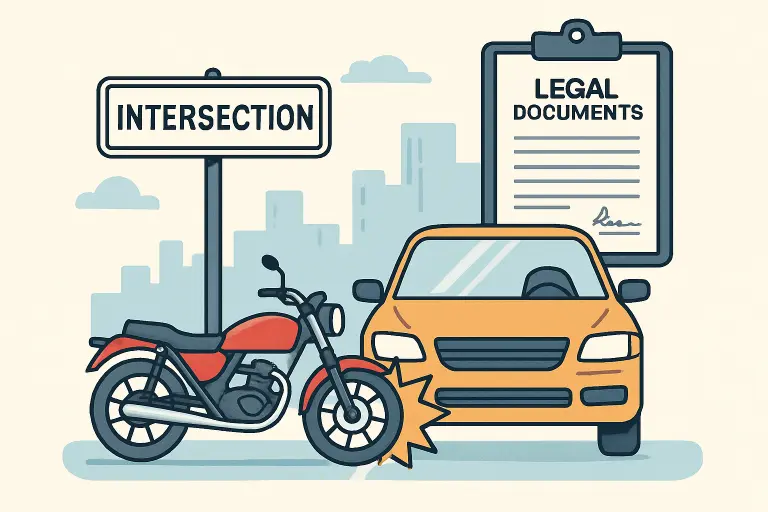

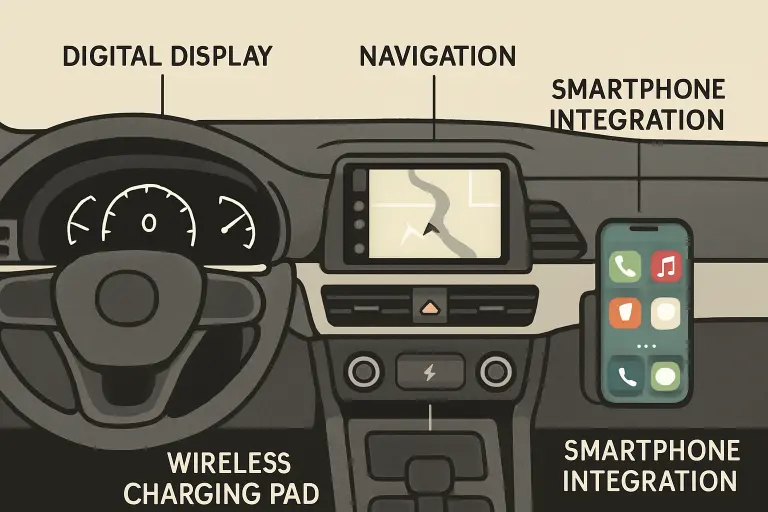

Car Repairs: A sudden breakdown or accident can leave you without transportation. Payday loans can get you back on the road swiftly.

Utility Bills: Unexpectedly high utility bills can throw your budget off balance. Payday loans can help you avoid late fees and disconnections.

Home Repairs: A leaky roof or a broken furnace can’t wait. Payday loans can provide the funds you need for essential home repairs.

Unforeseen Travel: Sometimes, family emergencies or other unexpected events require you to travel at a moment’s notice. Payday loans can cover travel expenses.

Conclusion

While unexpected bills can be stressful, payday loans offer a reliable solution for many individuals facing such financial challenges. With their speed, accessibility, and flexibility, payday loans can help you navigate through unexpected expenses with ease. Remember, however, to borrow responsibly and only when necessary, and always choose a reputable lender that adheres to the regulations in your state. When used wisely, payday loans can indeed save the day when life throws you a financial curveball.

0