Table of Contents

An Introduction to Health Benefits Brokerage

At its core, the profession of health benefits brokerage involves connecting individuals and organizations with the most appropriate and cost-effective health insurance plans. Brokers must be well-versed in various insurance products and skilled in assessing their clients’ specific health coverage needs. As trusted advisors, they are essential in educating clients about their options, helping them understand complex medical terms, and guiding them toward making informed decisions. With a shift towards the digital realm, brokers nowadays have more significant advantages and challenges. They are expected to provide quick access, transparent processes, and detailed data analytics to increasingly tech-savvy clients. To thrive in this new era, effective brokers are learning to seamlessly sell dental insurance benefits and other healthcare products into a comprehensive digital strategy.

The Digital Transformation of the Broker Industry

The role of technology in transforming health benefits brokerage cannot be understated. Digital tools have allowed brokers to serve their clients with a new level of efficiency. For example, the rise of online marketplaces has dramatically changed the landscape, allowing clients to compare numerous health plans in real-time. Brokers now utilize sophisticated algorithms to crunch large data sets to provide personalized plan recommendations. In addition, they adopt technology for more straightforward administrative tasks, such as automating enrollment processes or client management systems, focusing more on strategic advisory services. This paradigm shift challenges traditional brokers to upgrade their technological capabilities while offering them a chance to redefine their roles and enhance the value they provide to clients.

The Importance of Staying Informed: Educational Resources for Brokers

As the industry evolves rapidly, continual education becomes more pressing. Health benefits brokers are expected to keep pace with new insurance products, wellness programs, and legal and regulatory updates affecting insurance plans. This knowledge is crucial for providing accurate advice and maintaining trust with clients. Fortunately, ample professional development resources are available, including industry journals, webinars, and online courses. Staying informed means more than just keeping one’s knowledge fresh; it signifies a dedication to excellence and client service.

Navigating Client Needs in a Digital World

In the age where digital interfaces are ubiquitous, understanding and managing client expectations require more than the conventional one-size-fits-all approach. Today’s clients seek personalized advice and insurance solutions that align with their needs, whether for personal health plans or businesses. Advanced analytics and client relationship management systems have become crucial tools for brokers seeking to organize their offerings efficiently. With the right digital tools, brokers can gain insights into client histories, preferences, and needs, enabling them to craft individualized plans and advice. Furthermore, given the convenience digital solutions provide, clients are more inclined to seek out brokers who can offer a seamless online experience – from initial consultation to policy management.

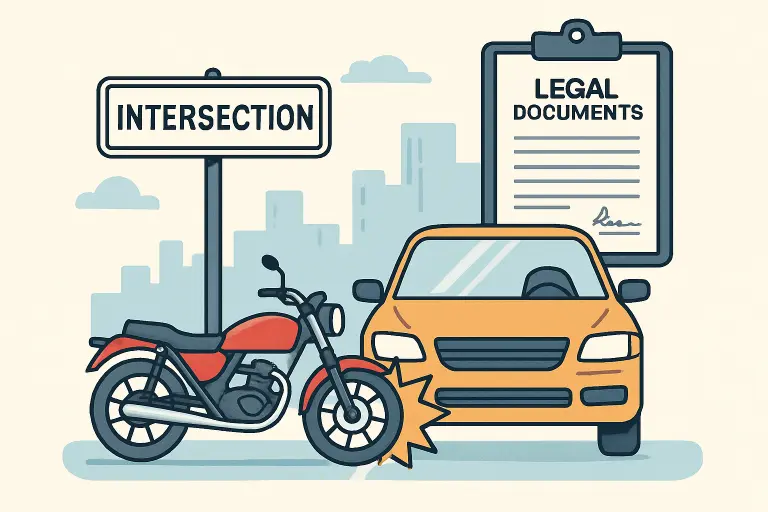

Compliance and Regulation Updates for Brokers

Remaining compliant in an industry as heavily regulated as health insurance is no small feat. New laws and regulations continually reshape the landscape, and the broker must understand and adapt to these changes. Penalties for non-compliance can be severe in terms of legal repercussions and the erosion of client trust. The National Association of Insurance Commissioners (NAIC) is one such body that provides guidance and resources on the latest in state and federal regulations. By keeping well-informed about compliance issues and leveraging resources offered by regulatory bodies, brokers can ensure they provide services that align with the current legal framework and demonstrate their commitment to ethical practice.

Innovative Tools and Platforms for Brokers

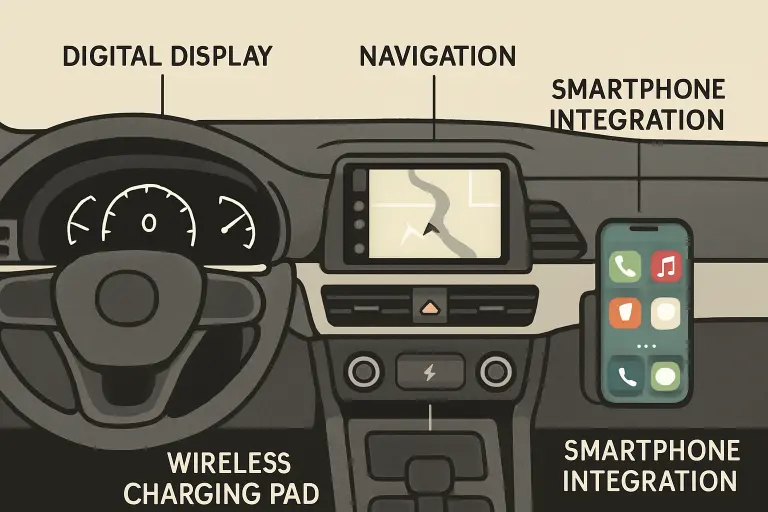

Emerging health insurance technology provides brokers powerful new ways to meet their clients’ needs. For instance, cloud-based platforms offer an accessible repository for client data, secure communication channels, and tools for collaborative decision-making. Mobile apps enable brokers to provide clients with on-the-go access to their insurance plans and wellness tools. There’s also a growing trend in using artificial intelligence to predict trends, automate routine tasks, and even provide virtual assistance to clients—increasing efficiency and reducing the potential for human error. The strategic deployment of these innovative tools improves client service and ensures a broker’s relevance in an increasingly competitive market.

Building Relationships and Trust in a Digital Marketplace

While technology has reshaped the broker’s toolkit, the importance of personal relationships and trust in the brokerage business remains unchanged. Brokers recognize that trust is the cornerstone of any successful relationship and are thus finding ways to build rapport in the digital sphere. A broker’s online presence, responsiveness, and transparency are fundamental in demonstrating reliability and a client-first approach. By employing social media effectively and running informative blogs or newsletters, brokers can maintain regular communication and engage with clients meaningfully. These digital touchpoints offer clients valuable insights and reinforce the broker’s role as a trusted advisor, even in an online environment.

Overcoming Challenges Faced by Today’s Health Benefits Brokers

The modern broker encounters many challenges beyond the complexity of health insurance products. Data protection, for instance, is a significant concern in an era where cyber threats are rampant. Brokers have to ensure the utmost security of their clients’ sensitive information. Similarly, adapting to advancing technologies and managing many digital platforms can take time and effort, especially for traditionally operated offline brokers. However, these challenges also present opportunities for growth and innovation. Brokers who tackle these obstacles head-on, whether by pursuing further education, investing in cybersecurity, or embracing new operational models, can differentiate themselves and excel in the marketplace.

The Future of Health Benefits Brokerage

The future is bright for health benefits brokers who embrace change and strive for innovation. The trend towards personalized, tech-enabled solutions is expected to continue, and those agile and tech-savvy brokers will likely find themselves at the forefront of the industry. The focus on data analytics and predictive modeling will intensify, providing brokers with unprecedented capabilities to forecast trends and design insurance solutions. Additionally, virtual consultations and telemedicine are proving to be more than a temporary convenience; they are reshaping how health services are delivered and managed, suggesting a future where the digital domain will be even more integrated into every aspect of health benefits brokerage.

0