Embarking on the wealth accumulation journey often involves complex financial decisions and extensive planning. Wealth management is an advisory discipline that combines various financial services to address the needs of affluent clients. A considered approach to wealth management can make the difference between preserving wealth for future generations and facing potential financial pitfalls. The right wealth management strategy encapsulates personalized investment advice, strategic tax planning, and measures to protect and increase capital based on your risk preferences and financial goals.

Table of Contents

What is a Multi-Family Office (MFO)?

A comprehensive wealth management solution for managing vast and diverse assets, a multi-family office provides many services tailored to the sophisticated requirements of affluent families. This dynamic financial model serves several clients under a single umbrella, benefiting them from shared experience and economies of scale. The MFO brings the expertise of various professionals, including financial planners, attorneys, and accountants, under one roof to provide detailed attention to intricate financial landscapes. In this way, families sharing similar complexities in wealth management can enjoy superior services and reach their financial objectives more seamlessly.

Signs You Could Benefit from a MFO

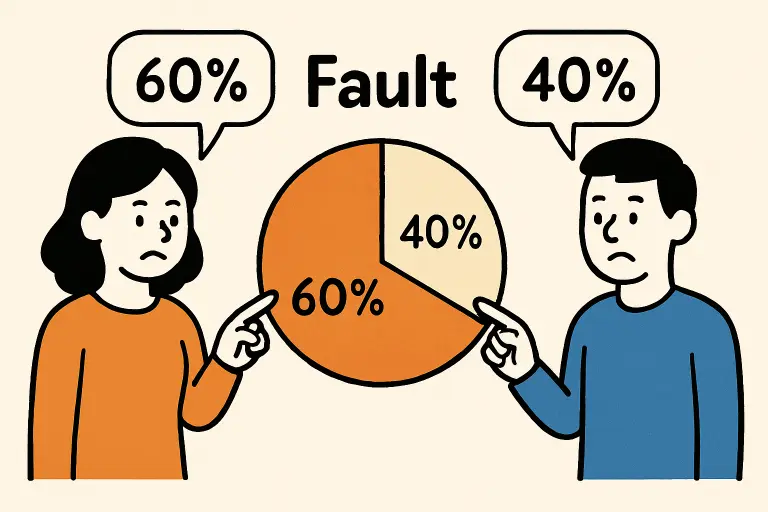

The shift toward using a multi-family office comes when families recognize that their wealth management needs exceed the scope of typical financial advisory services. Signs that you need the services of this kind of office include the sophistication of your asset portfolio, international investment interests, and the desire for more integrated financial advice across all aspects of your estate. For those who encounter the challenges of various interlocking legal and tax jurisdictions or wish to ensure their wealth has a lasting and positive impact through philanthropic endeavors, a multi-family office’s tailored services become invaluable.

Analyzing the Value of a Multi-Family Office

In wealth management, the value of an MFO is best appreciated through the lens of customization and intimacy. An MFO is more than just an advisory service; it is a close-knit collaboration between the client and a dedicated team that becomes intimately acquainted with the family’s wealth management needs, preferences, and long-term objectives. Their comprehensive services may encompass family governance and education, helping to inculcate a culture of financial competency among younger family members. Perhaps most notably, they offer a high degree of personalization, crafting strategies and solutions that respect each family’s unique narrative and aspirations.

How Multi-Family Offices Differ from Traditional Wealth Management

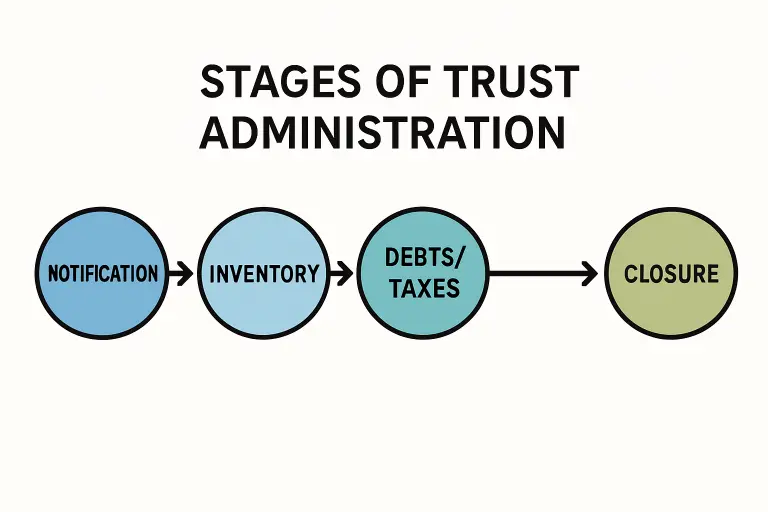

While traditional wealth management firms may provide robust investment advice and financial planning, MFOs deliver more services—from mundane tasks like household payroll management to sophisticated governance for family trusts and entities. With a penchant for exhaustive due diligence and far-reaching insight, MFOs can act as the central command for all aspects of their client’s financial worlds, thus offering peace of mind and freeing time to pursue personal endeavors.

0