Key Takeaways:

- Gain insight into the critical importance of comprehensive liability coverage for golf carts to safeguard against unforeseen accidents and claims.

- Learn about the distinct types of insurance available for golf carts and why choosing the right combination is pivotal for complete protection.

- Understand the varying regulations surrounding golf cart insurance requirements and how adhering to these ensures a smoother, worry-free experience.

Table of Contents

Introduction

The advent of golf carts as more than just sports equipment has become a staple in various settings, such as private communities, large estates, and urban developments. As this trend continues, the potential risks associated with their usage have increased, highlighting an urgent need for adequate liability coverage. Whether serving as a convenient means to navigate a sprawling campus or offering leisurely rides around a quaint neighborhood, golf carts bring immense convenience and inherent risk. Addressing these risks responsibly through robust insurance coverage is paramount, ensuring that you, as a golf cart owner, are shielded from unforeseen liabilities and financial drawbacks that might otherwise arise. This comprehensive guide delves into everything you need to know to navigate the complex yet crucial world of golf cart liability coverage.

Why Liability Coverage Is Essential

In golf carts, liability coverage serves as the cornerstone of responsible ownership. As these versatile vehicles become widely used beyond the confines of the golf course, they introduce new risks that require proactive management. Liability coverage is indispensable because it protects you from the financial burdens associated with accidents that cause damage to property or personal injury. These scenarios could arise unexpectedly in any community or environment where golf carts are used extensively. Whether inadvertently striking a parked car or accidentally injuring a pedestrian, such mishaps could leave you facing financial hardship if you lack the proper coverage. By investing in affordable golf cart insurance, you mitigate potential costs associated with legal defense, medical expenses, and claims settlements, ultimately allowing you to enjoy the benefits of your golf cart with greater peace of mind.

Additionally, liability coverage can provide reassurance when operating in public spaces, where the risk of accidents increases. It can also cover incidents involving other parties, protecting you in case a third party sues for damages or injuries. Golf carts often lack larger vehicles’ safety features, making liability coverage even more critical in reducing exposure to significant financial risks. Many areas now require golf cart owners to have proof of liability coverage before allowing use on public roads or private communities. With the right coverage, you ensure that your enjoyment of your golf cart remains uninterrupted, knowing you’re financially protected in the event of an unforeseen incident.

Types of Coverage for Golf Carts

When safeguarding your golf cart, understanding the variety of coverage options available is paramount. Liability insurance is the most basic form, protecting against damages you might be liable for. Comprehensive coverage extends your protection, covering non-collision events such as theft, acts of vandalism, or weather-induced damages. This coverage is particularly crucial in areas prone to frequent storms or where theft is a concern. Collision insurance, on the other hand, is designed to handle the repair costs following an accident, whether you’re at fault or not, providing critical support against unforeseen repair bills. Moreover, uninsured/underinsured motorist coverage fills gaps in scenarios where you’re involved in an incident with someone lacking adequate insurance. You can comprehensively shield your investment against various potential risks by tailoring these coverage elements to meet your needs.

Additional options like medical payment coverage can help cover medical costs if you or your passengers are injured during an accident, regardless of fault. Roadside assistance coverage is also worth considering, as it provides peace of mind if your golf cart breaks down while on the course or the road. Off-road coverage may benefit golf carts in more rugged environments, protecting against damage sustained during off-path use. Some policies even offer custom equipment coverage to protect any upgrades or accessories you may have added to your golf cart. Finally, rental reimbursement coverage can provide a replacement vehicle if your golf cart is being repaired due to a covered incident, ensuring you’re never without transportation.

Understanding Regulatory Requirements

Regulatory requirements for golf cart insurance vary widely, depending on geographic and jurisdictional nuances. While some states consider golf carts akin to regular motor vehicles with similar insurance mandates, others may impose more relaxed regulations, particularly when use is restricted to private property or closed communities. Navigating this regulatory maze is crucial, as operating without appropriate coverage can lead to legal penalties, fines, and liability for damages. For instance, driving your golf cart on public roads without complying with local insurance laws could lead to more severe complications than mere fines, including impounding your cart. Examining auto insurance statistics reveals these regulations’ pivotal role in creating safety nets that protect all road users. By understanding and adhering to these requirements, you ensure legal compliance and enhance safety and accountability within the community.

Additionally, local municipalities may have specific rules regarding golf cart use, requiring different insurance coverage based on factors like engine size or maximum speed. In some regions, golf carts may be required to carry liability coverage for bodily injury or property damage, ensuring that drivers are financially responsible for any accidents they cause. Some jurisdictions may even require proof of insurance before a golf cart can be registered on public roads. Understanding the specific insurance options available, such as liability, collision, or comprehensive coverage, can help ensure you meet or exceed the minimum requirements. Stay informed about these regulations ensures peace of mind and protects drivers and other individuals sharing the road.

Choosing the Right Insurance Plan

Choosing an insurance plan that best suits your golf cart needs involves a strategic approach, starting with a comprehensive assessment of how, when, and where you use your cart. Recognizing the risks associated with these variables enables you to select coverage types that mitigate these risks effectively. It’s prudent to request multiple quotes from reliable insurers, allowing comparisons highlighting the breadth of coverage offerings and rates and terms to align budget considerations. As you evaluate each policy, consider details such as coverage limits, deductibles, and specific exclusions to avoid unpleasant surprises. By consulting with experienced insurance agents, you can also gain deeper insights into the nuances of policies, ensuring you select a plan that aligns firmly with your operational and personal needs, securing both peace of mind and financial security against liability claims or other related issues.

Additionally, consider any special features you might require, such as accessory coverage or protection against theft or damage during transit. Some policies offer add-ons that can extend your coverage to include usage in more specific environments, like public roads or off-road areas. Consider the insurer’s reputation for handling claims, as prompt and fair claims service can make a significant difference in case of an accident. Another essential factor is understanding how coverage applies in different scenarios, including driver age restrictions or location-specific rules. Finally, review the terms periodically to ensure your plan remains up-to-date and continues to meet your evolving needs as your cart usage or lifestyle changes.

Enhancing Your Coverage

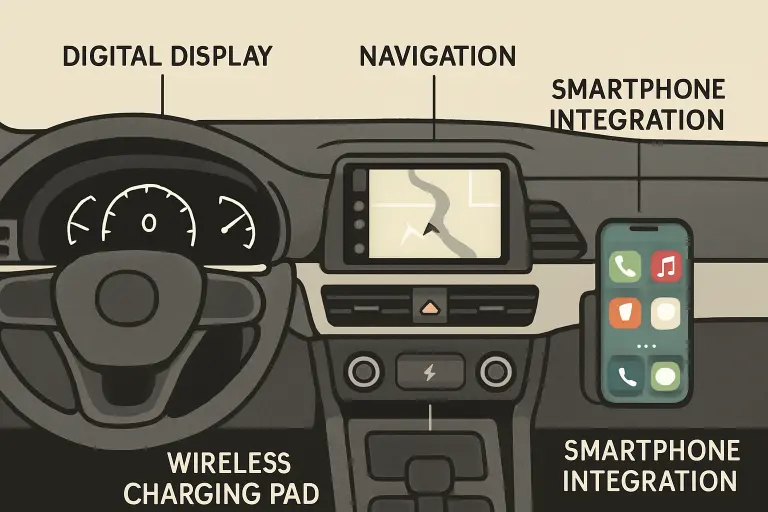

Enhancing the coverage of your golf cart insurance involves exploring additional layers of protection that go beyond the standard options. Bundling your golf cart policy with other existing coverages, such as home or auto insurance, can provide significant cost savings and organizational efficiencies. Installing anti-theft devices, alarms, or GPS tracking systems can deter theft and qualify you for premium discounts due to lowered risk profiles. Moreover, investing in regular maintenance keeps your golf cart in top condition, reduces the likelihood of mechanical failures, and can be a factor in negotiations for lower insurance rates. Keeping abreast of any policy updates and regularly reviewing your insurance plans ensures that your coverage remains aligned with changing circumstances, whether they involve regulatory shifts or personal usage patterns. These proactive measures, combined with the insights gained from industry developments, enhance the strength and adaptability of your insurance coverage.

Additionally, higher liability limits can provide added protection in an accident, especially if you’re using your golf cart on public roads or in areas with higher traffic. Some policies offer specific add-ons for off-road use, which can help take your golf cart onto trails or more rugged terrain. Adding personal injury protection or medical expense coverage can also offer peace of mind in case of an accident, covering any unexpected medical costs. If you frequently travel with passengers, securing passenger coverage ensures that everyone is protected in the event of an incident. Lastly, considering coverage for accessories like custom wheels or upgraded features ensure that any added value to your golf cart is fully covered in the event of damage or loss.

Conclusion

In summary, securing appropriate liability coverage for your golf cart is essential in safeguarding against potential financial and legal issues arising from accidents. By understanding the types of insurance available and the specific regulatory requirements in your area, you can tailor your coverage to meet your unique needs and ensure compliance with local laws. Thoughtful selection of insurance protects your assets and contributes to the safety and harmony of the community in which you navigate your golf cart. Through strategic planning and regular policy reviews, you’ll maintain robust protection that allows you to enjoy the many benefits of golf cart ownership with confidence and peace of mind, knowing you are protected against unforeseen situations.

0