Key Takeaways:

- Federal tax credit management firms can help investors maximize their tax benefits and reduce financial liabilities.

- Investing through these firms provides access to expert knowledge and resources that streamline the investment process.

- Using federal tax credits effectively can result in significant financial gains and support for community and sustainable projects.

- Learning about various types of federal tax credits, like renewable energy and low-income housing credits, is essential.

- Engaging a federal tax credit management firm can ensure compliance with legal requirements and optimize financial outcomes.

Table of Contents

Introduction

Investing wisely and efficiently is the cornerstone of financial growth and stability. One effective way to enhance your investment portfolio is by leveraging federal tax credits. These credits can significantly reduce tax liability while supporting projects that benefit communities and the environment. However, navigating the complexities of federal tax credits can be daunting. This is where federal tax credit management firms come into play. These firms specialize in helping investors maximize their benefits and streamline the investment process. This article will explore the numerous advantages of partnering with a federal tax credit management firm and how this can enhance your financial strategies.

Maximizing Tax Benefits

One of the primary advantages of working with a federal tax credit management firm is maximizing tax benefits. These firms have deep knowledge and expertise in various investment tax credit programs available at the federal level. Understanding the nuances of these programs can help investors take full advantage of the tax breaks available, leading to significant savings. Whether renewable energy credits, low-income housing credits, or historic preservation credits, these firms ensure you get the maximum benefit possible.

Additionally, these firms can provide strategic advice on structuring your investments to optimize tax benefits. They analyze your financial situation and recommend the best approach to take full advantage of applicable tax credits. This reduces your tax liability and enhances the overall return on your investments.

Access to Expert Knowledge

Federal tax credit management firms employ experts who specialize in the intricacies of tax credit programs. These professionals stay up-to-date with the latest regulations, requirements, and opportunities, ensuring their clients receive the most accurate and beneficial advice. This expertise is invaluable, especially considering tax credit programs’ complexity and frequently changing nature.

By leveraging the knowledge of these experts, investors can feel confident in their decisions and strategies. This helps maximize financial benefits and avoids potential pitfalls and costly errors. The guidance these firms provide can make a significant difference in the overall success of your investment portfolio.

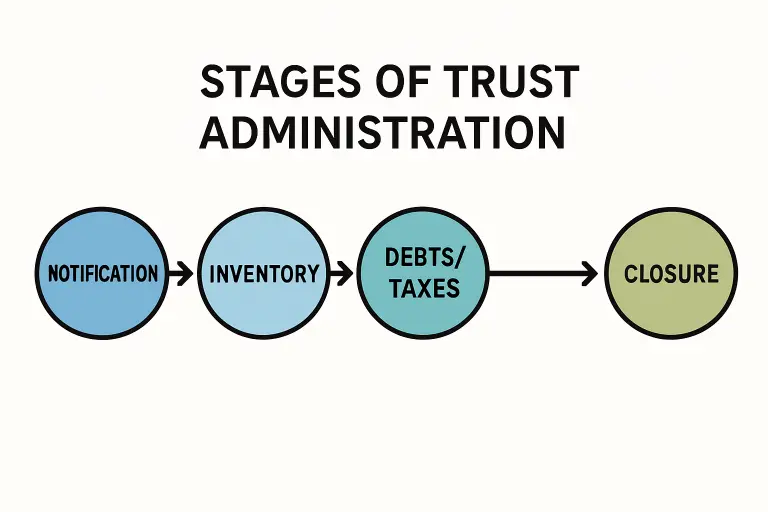

Streamlining the Investment Process

Another significant benefit of working with a federal tax credit management firm is streamlining the investment process. These firms handle the complicated and time-consuming tasks associated with tax credit investments, including researching eligible projects, navigating compliance requirements, and managing documentation.

This level of support allows investors to focus on other aspects of their financial strategy, knowing that professionals are managing the complexities of tax credit investments. The streamlined process saves time, reduces stress, and ensures that all necessary steps are completed accurately and efficiently.

Types of Federal Tax Credits

There are several types of federal tax credits that investors can take advantage of through the assistance of a tax credit management firm. Some of the most common include:

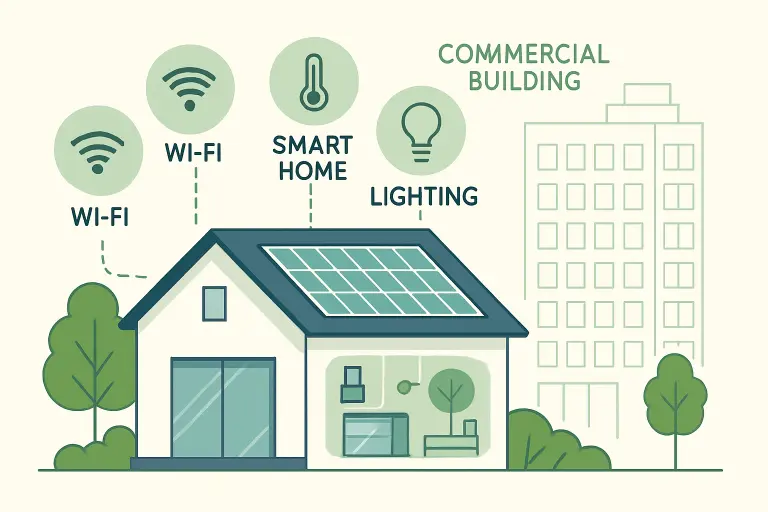

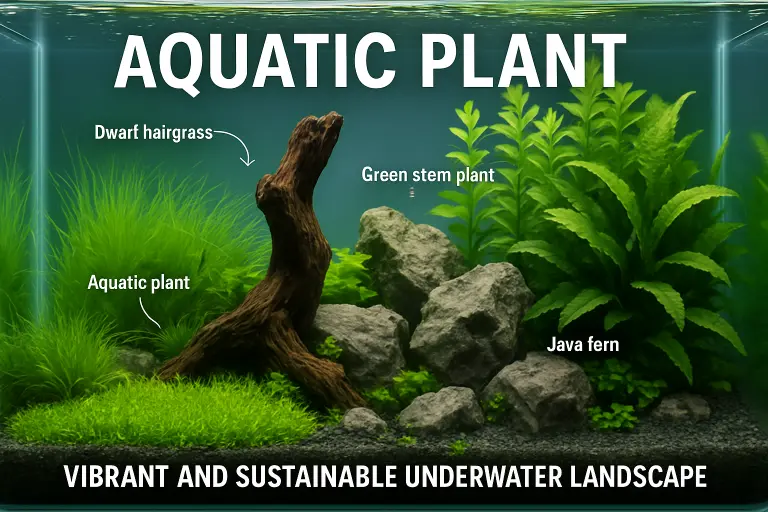

- Renewable Energy Credits: These credits support investments in renewable energy projects like solar, wind, and geothermal energy. They provide substantial tax benefits while promoting sustainable energy solutions.

- Low-Income Housing Credits: These credits incentivize the development of affordable housing projects. They offer tax relief to investors while addressing housing needs in communities.

- Historic Preservation Credits: These credits encourage the restoration and preservation of historic buildings and offer tax incentives for projects that maintain communities’ cultural heritage.

- Employment Credits: These credits provide tax breaks for businesses that hire from targeted groups, such as veterans or individuals from disadvantaged backgrounds.

Understanding the different types of federal tax credits and identifying which ones align with your investment goals can be challenging. Federal tax credit management firms can help you navigate these options and choose the best investment avenues.

Supporting Community and Sustainability Projects

Investing through federal tax credit programs often supports projects that have significant social and environmental impacts. For example, renewable energy projects contribute to sustainability by reducing carbon emissions and promoting clean energy. Similarly, low-income housing projects address critical housing shortages and improve living conditions for underserved populations.

By participating in these programs, investors can align their financial goals with their values, contributing to positive change while earning returns. Federal tax credit management firms are crucial in identifying and facilitating these impactful investments. They ensure that projects meet eligibility criteria and deliver meaningful benefits to communities and the environment.

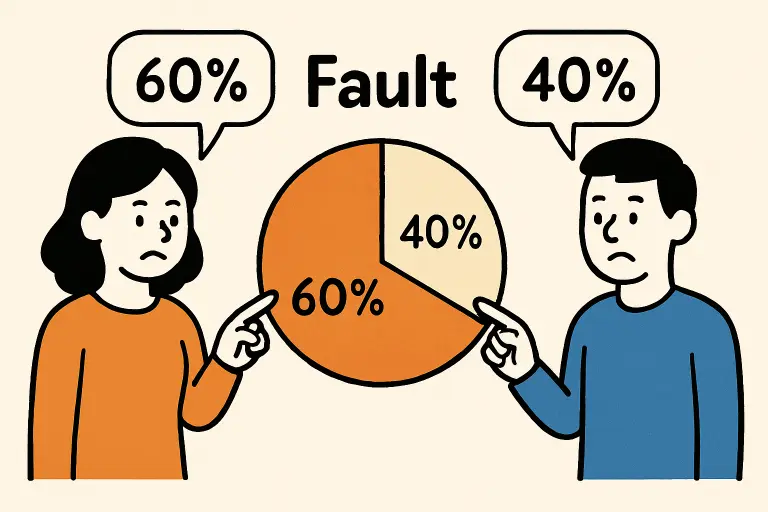

Ensuring Legal Compliance

Compliance with federal tax credit regulations is critical to securing and maintaining the benefits of these programs. Federal tax credit management firms are well-versed in these investments’ legal requirements and compliance procedures. They help investors navigate the complex landscape of rules and regulations, ensuring that all actions align with legal standards.

Failure to comply with these requirements can result in the loss of tax credits and potential legal consequences. By engaging a federal tax credit management firm, investors can mitigate these risks and ensure that their investments are structured and executed correctly. This peace of mind lets investors focus on their financial strategies without worrying about compliance issues.

Conclusion

Investing with a federal tax credit management firm offers numerous benefits, from maximizing tax savings to supporting impactful community projects. These firms provide invaluable expertise, streamline complex processes, and ensure compliance with legal requirements. By leveraging their knowledge and resources, investors can enhance their financial strategies and achieve significant returns while contributing to positive social and environmental outcomes. Engaging with a federal tax credit management firm can be a game-changer for investors looking to optimize their portfolios and make a meaningful impact.

0